目次

Summary

The Payment Services Act regulates prepaid payment instruments in online games, such as in-app currencies, requiring operators to adhere to specific obligations. These obligations include notification requirements to the Finance Bureau, securing funds in case of an unused balance exceeding 10 million yen, providing necessary information to the players, and additional obligations such as data security and handling complaints.

If operators fail to comply with the myriad requirements, especially in securing funds, they may face penalties including imprisonment for up to six months and/or a fine of up to 500,000 yen. Additionally, they may be subject to administrative sanctions (such as the suspension of in-game item sales) by the Financial Services Agency, the competent authority of the Payment Services Act.

It is important to note that these obligations may apply even to foreign game operators selling in-game items in Japan. Yet, there have been some instances of foreign operators who, despite being under an obligation to do so, do not secure their funds. This has been viewed as a serious problem by the Financial Services Agency, which even took the extra step to publish a document to raise awareness and ensure compliance among foreign operators.

Introduction

The digital gaming landscape in Japan has experienced exponential growth. According to a Market Research report on Electronic Commerce conducted by the Ministry of Economy, Trade and Industry (METI), as of August 12, 2022, the domestic online gaming sector has witnessed a drastic surge, escalating to a staggering value of 1.6127 trillion yen in 2021.

Reference: METI Report

A majority of these online games, which are downloadable at no cost, incorporate a model wherein players are allowed to purchase in-game coins and items. These purchases further assist in accelerating game progression or facilitate participation in events.

However, if such in-game coins and items are classified as “prepaid payment instruments” under the Payment Services Act, they fall within the purview of the Act, thus subjecting game operators to its regulations. Therefore, it is critical for operators to fully comprehend these legal provisions and ensure stringent adherence to them.

The subsequent sections delve into the precise definition of “prepaid payment instruments,” their various categories, and associated obligations as set out in the Payment Services Act.

Understanding Prepaid Payment Instruments

Prepaid payment instruments represent a form of payment service that permits operators to collect money upfront from players for subsequent transactions. Given this characteristic, they fall under the jurisdiction of the Payment Services Act.

To be recognized as a prepaid payment instrument, as a rule, the following three criteria must be satisfied:

1. The value of money or other property must be explicitly stated and preserved;

2. The instruments must be issued in exchange for consideration; and

3. The instruments must be used to make payments for goods or services.

In the context of online games, in-app currency is often employed to facilitate gameplay or to purchase in-game items. As the value of this virtual currency is preserved on the game provider’s servers, it meets the first criteria.

In cases where this in-app currency is issued upon receiving corresponding consideration, it fulfills the second requirement.

Finally, if the in-app currency is utilized as a form of payment for goods or services, such as gameplay or item procurement, it satisfies the third criterion.

In light of the above, in-app currency generally fulfills the necessary conditions 1 through 3, and thus falls under the regulatory purview of the Payment Services Act.

Categorization of Prepaid Payment Instruments: “Issuer’s Own Business” or “Third-party”

The Payment Services Act recognizes two categories of prepaid payment instruments:

(1) Prepaid payment instruments for the issuer’s own business

(2) Prepaid payment instruments for a third-party business

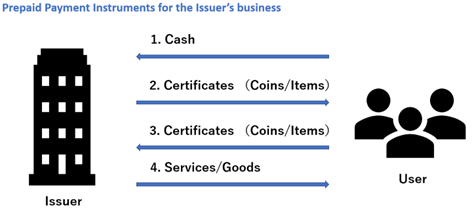

(1) Prepaid Payment Instruments for the Issuer’s Own Business

These instruments refer to those that can be exclusively used for purchasing goods or services provided by the issuer of the prepaid payment instruments. In addition to the issuers themselves, “closely related persons” to the issuer can also utilize these instruments. In order to be classified within this category, the issuers of the prepaid payment instruments must also be the providers of the goods or services that these instruments are employed to procure.

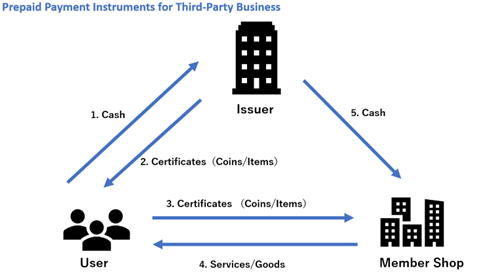

(2) Prepaid Payment Instruments for a Third-Party Business

These instruments can be utilized for payments at establishments or service providers other than the issuers.

Typically, coins and items within an online game can only be used within the confines of that particular game. Consequently, they are normally classified as prepaid payment instruments for the issuer’s business. In the following sections, we will outline the obligations imposed on issuers under the Payment Services Act, given the assumption that they are issuers of prepaid payment instruments for their own business.

Notification Obligations

If the unused balance of in-game currency exceeds a set standard amount (10 million yen) on the designated record dates (March 31 and September 30) each year, appropriate security measures must be taken. Issuance notifications, as well as other necessary documents, must be submitted to the responsible Finance Bureau, as described in the subsequent section.

The necessary documents for corporations include:

1. Issuance notification of prepaid payment instruments

2. Supporting Documents:

(a) Articles of Incorporation or Articles of Endowment

(b) Certificate of registered matters or an equivalent document

(c) Extract of the certificate of residence of the representative or administrator, or an equivalent document

(d) Should the previous name and title of the representative or administrator be indicated on the registration statement, a document verifying the former name and title of the representative or administrator is required

(e) The final balance sheet and profit and loss statement, or equivalent documents

(f) For companies with an accounting auditor, a document stating the contents of the accounting audit report for the business year preceding the submission date of the prepaid payment instruments issuance notification

(g) In the event a portion of the prepaid payment instruments issuance business is outsourced to a third party, the relevant outsourcing agreement is needed

(h) If closely related parties exist, a written statement confirming the close relationship is required

(i) A written statement of any other reference matters

The issuance notification form, as mentioned above in point 1, should also include basic information regarding the prepaid payment instrument issuers. This includes a summary of the prepaid payment instruments to be issued, copies of these instruments, and for instance, in the case of online game coins and items, information such as the quantity of coins, unit price, and a screenshot of the purchase screen.

Obligation to Secure Funds

As issuers of prepaid payment instruments receive money in advance from players for future payments, they are obligated to adopt measures to preserve these funds. This protection ensures player funds are safeguarded, even in the event of the issuer’s bankruptcy. Specifically, if the unused balance of issued prepaid payment instruments exceeds 10 million yen at the end of March or September, a deposit amounting to at least half of this unused balance must be made to the Legal Affairs Bureau. This deposit serves as security for issuance according to Article 14, Paragraph 1 of the Payment Services Act.

However, there are exceptions to this requirement. The obligation to deposit issuance security is waived if (i) an issuance protection agreement is established with a financial institution and the corresponding notification is submitted to the Director-General of the Local Finance Bureau, or (ii) an issuance trust agreement is established with a trust company and the corresponding notification is submitted to the Director-General of the Local Finance Bureau. These exceptions are detailed in Articles 15 and 16 of the Payment Services Act.

If the obligations for securing funds under the Payment Services Act are not complied with, there could be penalties such as imprisonment for six months or less and/or a fine of up to 500,000 yen. Additionally, the Financial Services Agency, the competent authority of the Payment Services Act, may impose administrative sanctions such as the suspension of in-game item sales.

Even for foreign game operators, when selling in-game items in Japan, there may be an obligation to secure funds. However, in reality, there are some instances of foreign operators who sell in-game items in Japan, despite bearing such obligations, do not secure their funds. The Financial Services Agency seems to regard this as a serious problem and has addressed the issue by publishing a document to raise awareness among foreign operators. Further, the Kanto Local Finance Bureau has conducted an on-site inspection of Line Corporation for violations of the Payment Services Act over its smartphone game items, although the ultimate administrative actions have not been disclosed publicly.

https://mainichi.jp/english/articles/20160406/p2a/00m/0na/020000c

Duty to Disclose Information

Article 13 of the Payment Services Act stipulates that issuers of prepaid payment instruments must provide or disclose certain information to players upon issuance. Therefore, it is critical to provide or display the necessary information either on the ticket itself or via other mediums such as websites, aligned with the anticipated service content.

Specifically, the following information should be made available:

(a) The issuer’s name, business name, or title

(b) Amount available or quantity of goods and services provided

(c) Usage period or expiration date, if applicable

(d) Contact information and location for player complaints or consultations

(e) Scope of facilities or locations where the instruments are valid

(f) Required usage precautions for the instruments

(g) Amounts recorded via electromagnetic means (either the unused balance itself or the means to ascertain such balance)

(h) In cases where there are terms and conditions, it is required to disclose their existence as well as pertinent information related to in-app currency refund scenarios.

Additional Obligations

Aside from the aforementioned obligations, the Payment Services Act also establishes the following responsibilities:

(a) The duty to securely manage information

(b) The duty to implement procedures for handling complaints

(c) Regular reporting requirements to the responsible governmental authority

(d) The duty to refund prepaid payment instruments if business operations cease

Further contact

Shinichiro (“Shin”) Mori

MANAGING PARTNER

T: +813-6831-9282

E: shinichiro.mori@mps-legal.com

Kentaro Sano

SENIOR ASSOCIATE

T: +813-6831-9283

E: kentaro.sano@mps-legal.com